Can the Baidu Index predict realized volatility in the Chinese stock market? | Financial Innovation | Full Text

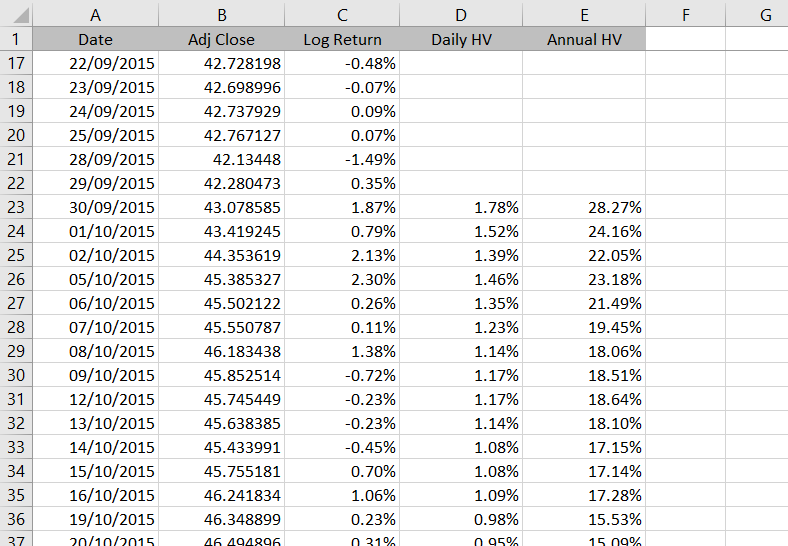

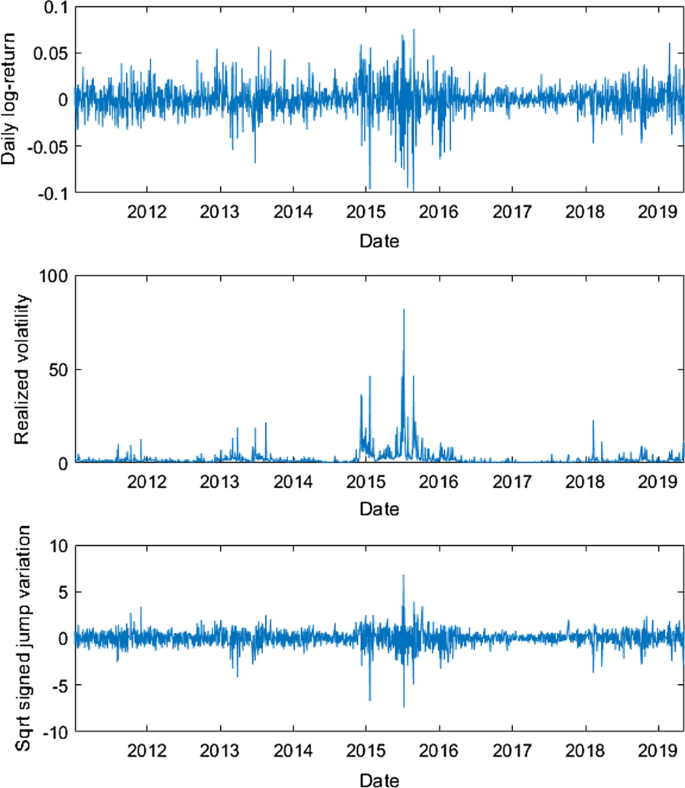

Realized volatility (left) and squared daily log-returns (right) of... | Download Scientific Diagram

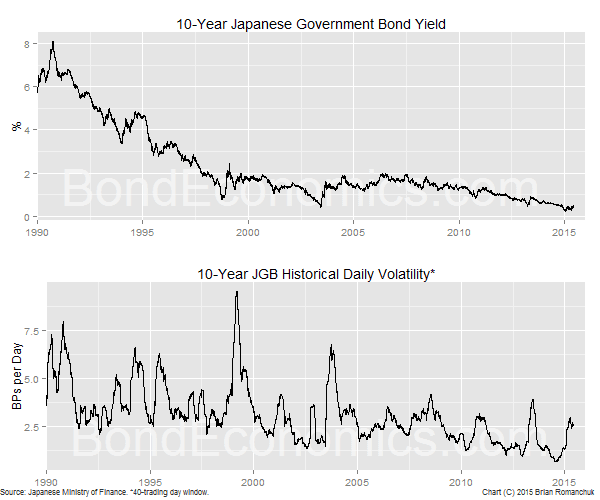

Impact of volatility jumps in a mean-reverting model: Derivative pricing and empirical evidence - ScienceDirect

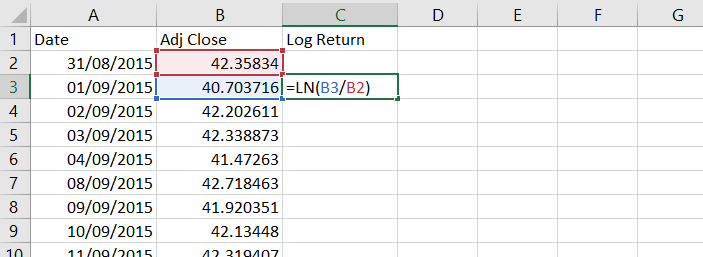

:max_bytes(150000):strip_icc()/dotdash_Final_The_Uses_And_Limitt_Of_Volatility_Jan_2020-7be5c97330c64237b3346a05c44013ce.jpg)